Joint Seminar of the Department of Probability Theory & Vega Foundation

The speakers of the seminar introduce the listeners to the latest achievements in the field of financial and actuarial mathematics.

The seminar is primarily aimed at undergraduate students of last two years, graduate students and PhD students. However, everyone can take part, having passed the preliminary registration.

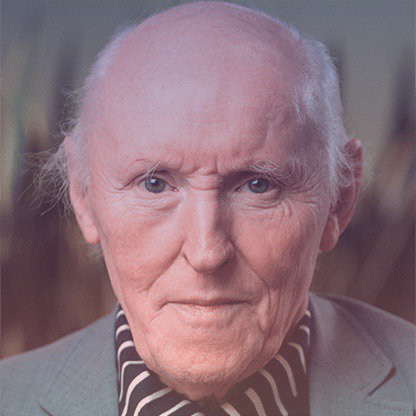

The leaders of the seminar are Academician of the Russian Academy of Sciences Albert Nikolaevich Shiryaev, Chief Executive Officer of the Foundation Kirill Yuryevich Klimov and Senior Researcher of the Steklov Mathematical Institute of Russian Academy of Sciences Mikhail Valentinovich Zhitlukhin

Sign up for the seminar

Teachers

Language: Russian, English

Format: online

SCHEDULE FOR THE SPRING SEMESTER' 24

April 10, 6:30-8:00pm (Moscow time)

Vincent LIANG

Melbourne University, Australia

On boundary crossing probabilities of diffusion processes

that a general time-inhomogeneous diffusion process

that a general time-inhomogeneous diffusion process  stays between two curvilinear boundaries

stays between two curvilinear boundaries  and

and  (possibly with

(possibly with  ) during a finite time interval.

) during a finite time interval. First we discuss a discrete time discrete space Markov chain approximation to

with a Brownian bridge correction for computing

with a Brownian bridge correction for computing  . For a broad class of

. For a broad class of  and diffusion processes, we prove the convergence of the constructed approximations to

and diffusion processes, we prove the convergence of the constructed approximations to  in the form of products of the respective substochastic matrices as the time grid is getting finer. Numerical results indicate that the convergence rate is

in the form of products of the respective substochastic matrices as the time grid is getting finer. Numerical results indicate that the convergence rate is  in the case of

in the case of  -boundaries and a uniform time grid with

-boundaries and a uniform time grid with  steps.

steps.In the second part of the talk, in the case when

we prove the existence of and obtain an explicit compact representation for the Gâteaux derivative

we prove the existence of and obtain an explicit compact representation for the Gâteaux derivative  of the boundary non-crossing probability functional in the direction

of the boundary non-crossing probability functional in the direction

Joint work with K.\ Borovkov.

April 3, 6:30-8:00pm (Moscow time)

Alexey METEYKIN

postgraduate student of the Probability Theory Department, Moscow State University

Optimal market making using market order flow information

Arthur SIDORENKO

postgraduate student of the Probability Theory Department, Moscow State University

The Meyer—Zheng Topology and Portfolio Investment with Proportional Transaction Costs

March 27, 6:30-8:00pm (Moscow time)

Igor KOZIK

dissertation candidate at the Department of Probability Theory (supervisor - V. Piterbarg)

Study and application of the connection between discrete and continuous time in modeling the trajectories of Gaussian processes taking into account high excursions

March 20, 6:30-8:00pm (Moscow time)

Evgeniy PCHELINTSEV

Head of the Laboratory of Statistics of Random Processes and Quantitative Financial Analysis, Tomsk State University

Efficient estimation of a regression function with small intensity L´evy noise

Based on Pinsker's method, an exact lower bound is found for the normalized mean square accuracy of the estimates. For a Sobolev ellipse with exponential coefficients, the lower bound is calculated explicitly from complete and incomplete data.

March 13, 6:30-8:00pm (Moscow time)

Jean JACOD

Université Pierre & Marie Curie, Paris VI, France

Systematic Jump Risk

March 6, 6:30-8:00pm (Moscow time)

Alexandra NOVIKOVA

postgraduate student of the Probability Theory Department, Moscow State University

Skorokhod embedding problem. On its key solutions and applications

February 28, 6:30-8:00pm (Moscow time)

Elina AKHUNJANOVA

6th year student of the Probability Theory Department, Moscow State University

Effects of intransitive interaction of customers on service characteristics in the M|M|1|2 system

Georgy MALINOVSKY

postgraduate student of the Probability Theory Department, Moscow State University

Limit theorems for subcritical Bellman-Harris branching processes with long particle lifetimes and doubly stochastic Poisson immigration

February 21, 6:30-8:00pm (Moscow time)

Sergey ASEEV

Corresponding member RAS, Head Department of Differential Equations Steklov Mathematical Institute

The Pontryagin maximum principle for infinite-horizon optimal control problems in economics

SCHEDULE FOR THE FALL SEMESTER' 23

November 29, 6:30-8:00pm (Moscow time)

Mikhail URUSOV

professor of the University of Duisburg-Essen, Germany

On certain stochastic control problems arising in optimal trade execution

We discuss how to extend the class of controls, first, from finite-variation processes to semimartingales and, second, beyond semimartingales. The need for such extensions arises when we introduce stochastically evolving liquidity parameters into the optimal trade execution problem.

The exposition covers some ideas from [1] and proceeds with [2].

This is a joint work with Julia Ackermann and Thomas Kruse.

References:

[1] Julia Ackermann, Thomas Kruse and Mikhail Urusov. Càdlàg semimartingale strategies for optimal trade execution in stochastic order book models. Finance and Stochastcis 25, 757-810, 2021. arXiv: https://arxiv.org/abs/2006.05863

[2] Julia Ackermann, Thomas Kruse and Mikhail Urusov. Reducing Obizhaeva-Wang type trade execution problems to LQ stochastic control problems. Accepted in Finance and Stochastics, 2023. arXiv: https://arxiv.org/abs/2206.03772

November 22, 6:30-8:00pm (Moscow time)

Marina MIKITCHUK

Postgraduate student, Moscow School of Economics, Moscow State University; scholarship holder of Vega Institute Foundation

Development assistance: the effectiveness of the benefit-oriented motive and its formation factors

November 15, 6:30-8:00pm (Moscow time)

Dean FANTAZZINI

Doctor of Economics, Professor of the Department of Econometrics and Mathematical Methods of Economics, Moscow School of Economics, Moscow State University

Detecting Pump-and-Dumps with Crypto-Assets: Dealing with Imbalanced Datasets and Insiders’ Anticipated Purchases

Detecting pump-and-dump schemes involving cryptoassets with high-frequency data is challenging due to imbalanced datasets and the early occurrence of unusual trading volumes. To address these issues, we propose constructing synthetic balanced datasets using resampling methods and flagging a pump-and-dump from the moment of public announcement up to 60 min beforehand. We validated our proposals using data from Pumpolymp and the CryptoCurrency eXchange Trading Library to identify 351 pump signals relative to the Binance crypto exchange in 2021 and 2022. We found that the most effective approach was using the original imbalanced dataset with pump-and-dumps flagged 60 min in advance, together with a random forest model with data segmented into 30-s chunks and regressors computed with a moving window of 1 h. Our analysis revealed that a better balance between sensitivity and specificity could be achieved by simply selecting an appropriate probability threshold, such as setting the threshold close to the observed prevalence in the original dataset. Resampling methods were useful in some cases, but threshold-independent measures were not affected. Moreover, detecting pump-and-dumps in real-time involves high-dimensional data, and the use of resampling methods to build synthetic datasets can be time-consuming, making them less practical.

November 8, 6:30-8:00pm (Moscow time)

Vladimir KUTSENKO

postgraduate student of the Probability Theory Department, Moscow State University

Simulation of branching random walks in a random environment

November 1, 6:30-8:00pm (Moscow time)

Ekaterina PALAMARCHUK

Cand. sc. in Mathematics and Physics, CEMI RAS, NRU HSE, MI RAS)

Study on linear stochastic control systems under non-ergodic optimality criteria

October 25, 6:30-8:00pm (Moscow time)

Platon PROMYSLOV

Postgraduate student, Department of Probability Theory, Moscow State University; scholarship holder of Vega Institute Foundation

Ruin probabilities for a Sparre Andersen model with investments: the case of annuity payments

October 18, 6:30-8:00pm (Moscow time)

Oleg KUDRYAVTSEV

Doctor of Physical and Mathematical Sciences, Associate Professor

Modern problems of computational financial mathematics

You can watch the meetings that took place earlier in the playlist of the Foundation's channel.

.jpg)